Billing

Invoices

- Applying balance from one invoice to the another one - Use credit note or overpaid invoice to settle another invoice

- Write off bank fees from invoice - If you received slightly less than the amount on the invoice due to bank fees, you write off the remaining balance as a bank fee

Manual creation of an invoice

There are 2 ways to create a Draft invoice line via Pending charges. This can be done as either Custom or Product, where Custom is made for the specific situation. Product can be used if you have something recurring.

Part 1: Custom

Step 1: New draft invoice line under Pending Charges

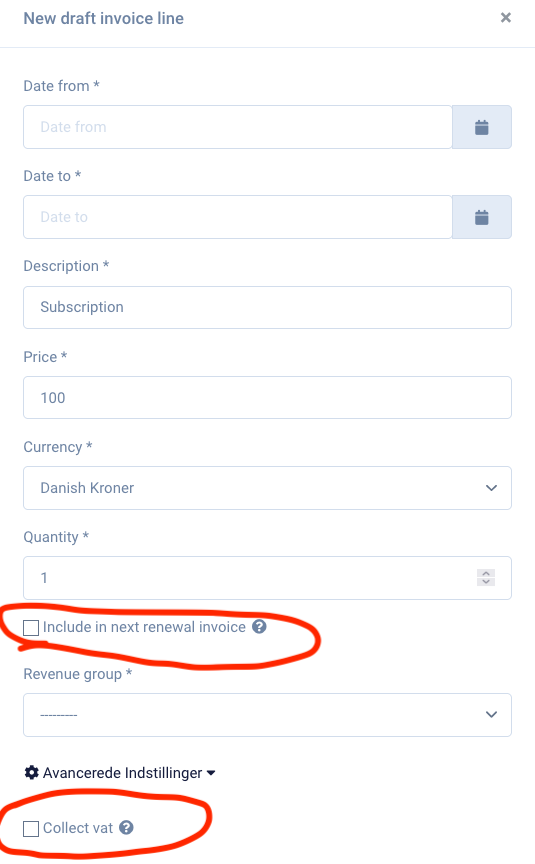

Create a draft invoice line with a positive amount. For example, 100 DKK, if you want to create an invoice for 100 DKK.

You can fill in the Description as you like. It is important that you decide whether the invoice should be included with the next bill or if it should be sent separately. Furthermore, it is also important that you decide whether VAT should be collected. You do this in the two red circles below.

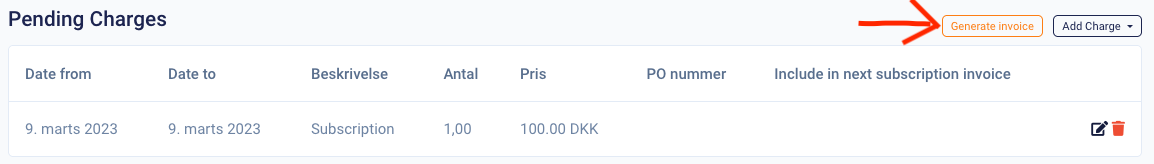

Step 2: Draft invoice line

Press generate invoice.

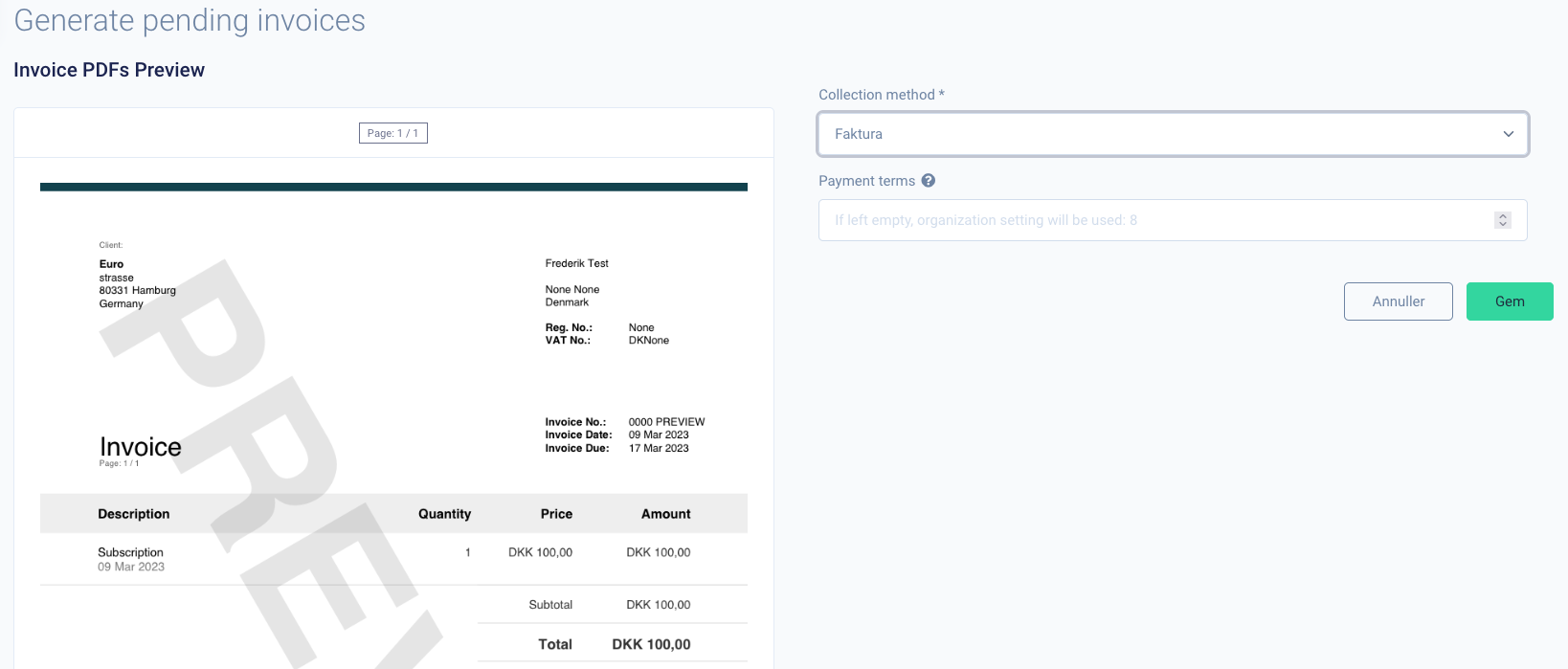

Step 3: Generate invoice

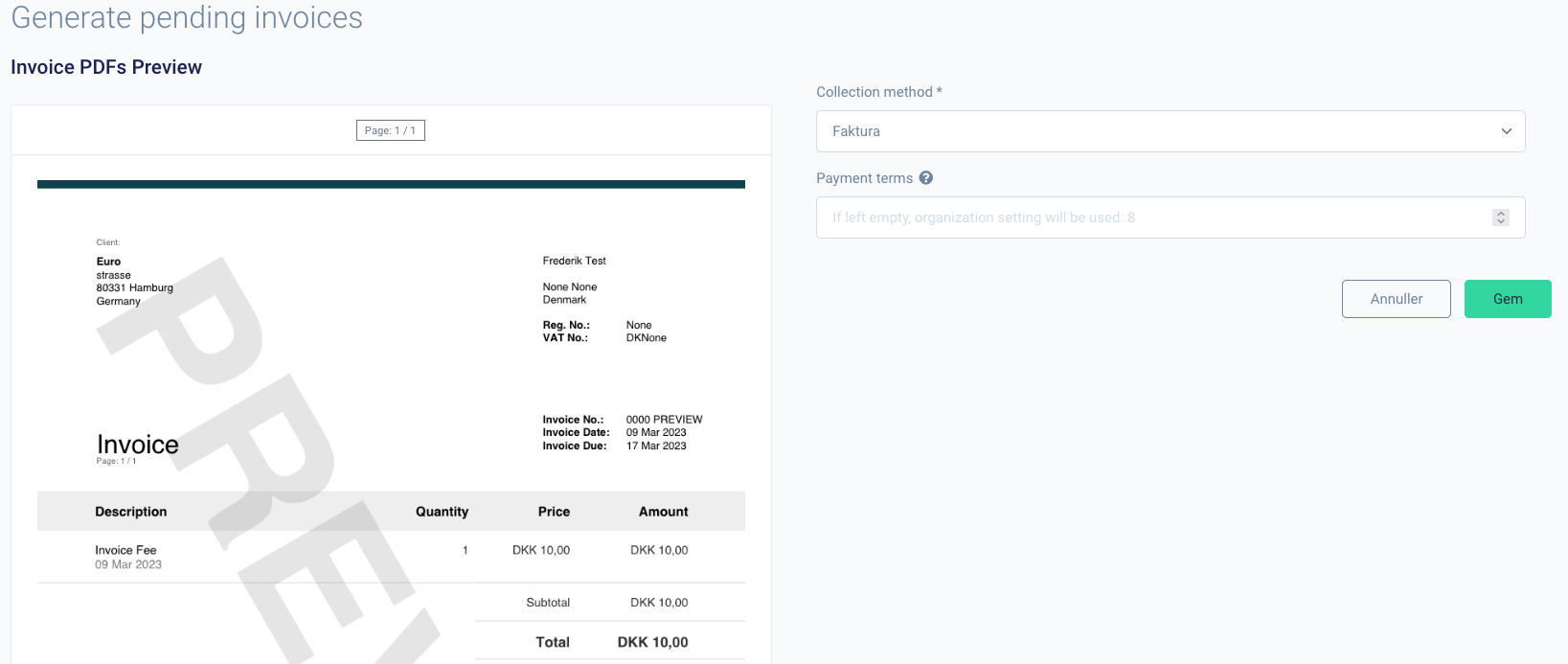

Here, the payment method must be selected under "Collection method", and the payment terms under "Payment terms". If "Payment terms" are not filled out, the default from the organization will be used.

Part 2: Products

You have the option to create a product. This would be appropriate if you have a product that is sold less frequently than a subscription but more than once. Here's how to create a product draft invoice line:

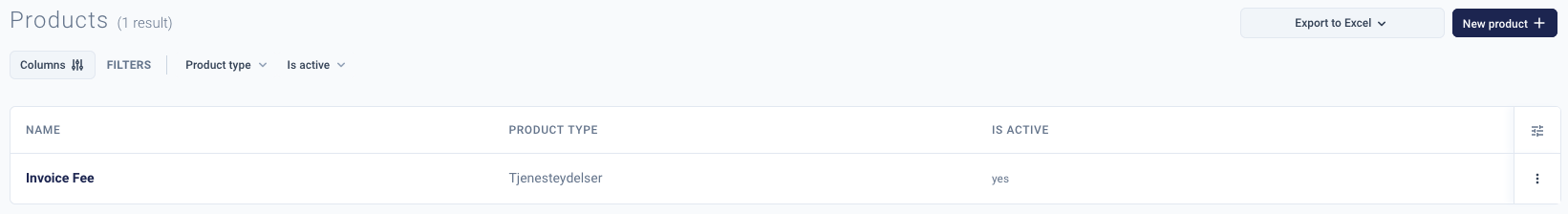

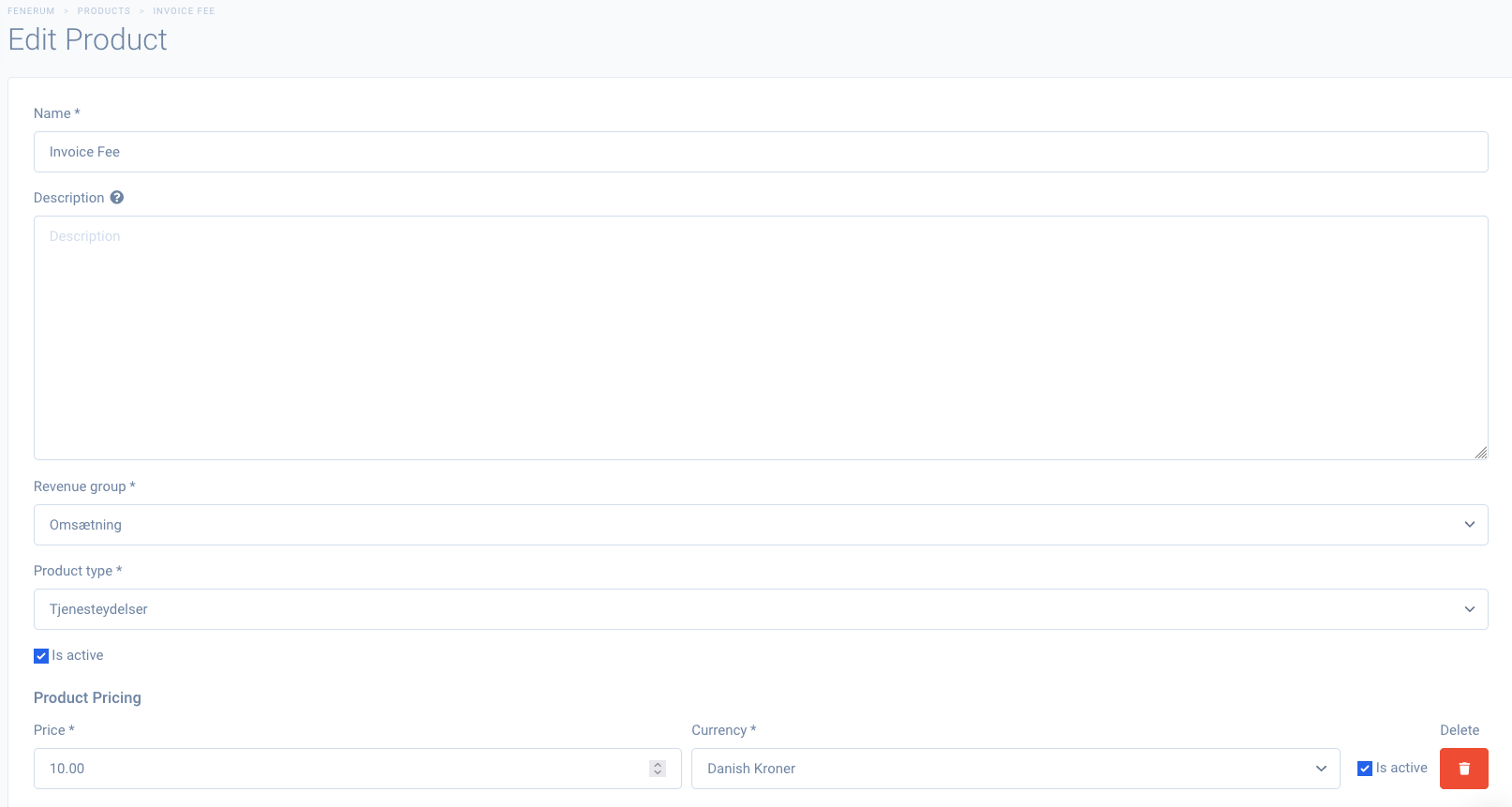

Step 1: Create a product

Under Products, you can create a new product that you will use to create this.

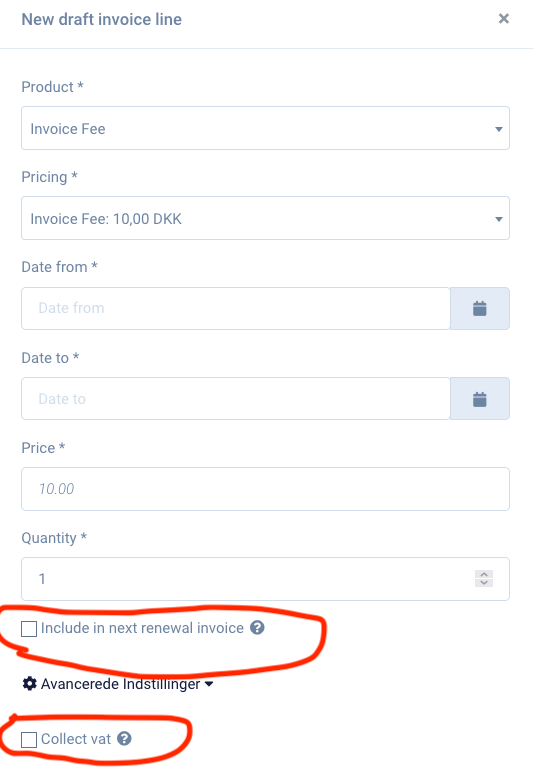

Step 2: New draft invoice line under Pending Charges

Here, you select the product you just created. It is important that you decide whether the invoice should be included with the next bill or if it should be sent separately. Furthermore, it is also important that you decide whether VAT should be collected. You do this in the two red circles below.

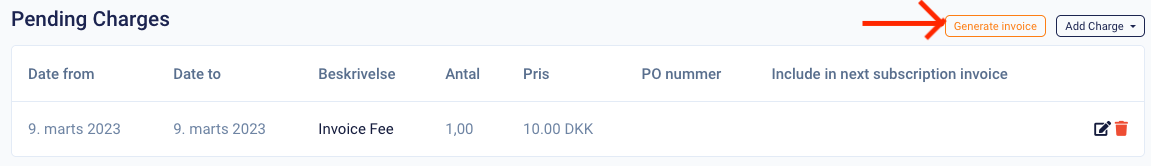

Step 2: Draft invoice line

Press generate invoice.

Step 3: Generate invoice

Here, the payment method must be selected under "Collection method", and the payment terms under "Payment terms". If "Payment terms" are not filled out, the default from the organization will be used.

Pay-now with credit card

Pay-now is a feature that allows you to resend credit card payment requests to your customers. This function is also intended to resend invoices that were initially sent with the payment method "invoice" but the customer now wants to pay with a credit card.

When to use Pay-now

The Pay-now function is created to address two situations.

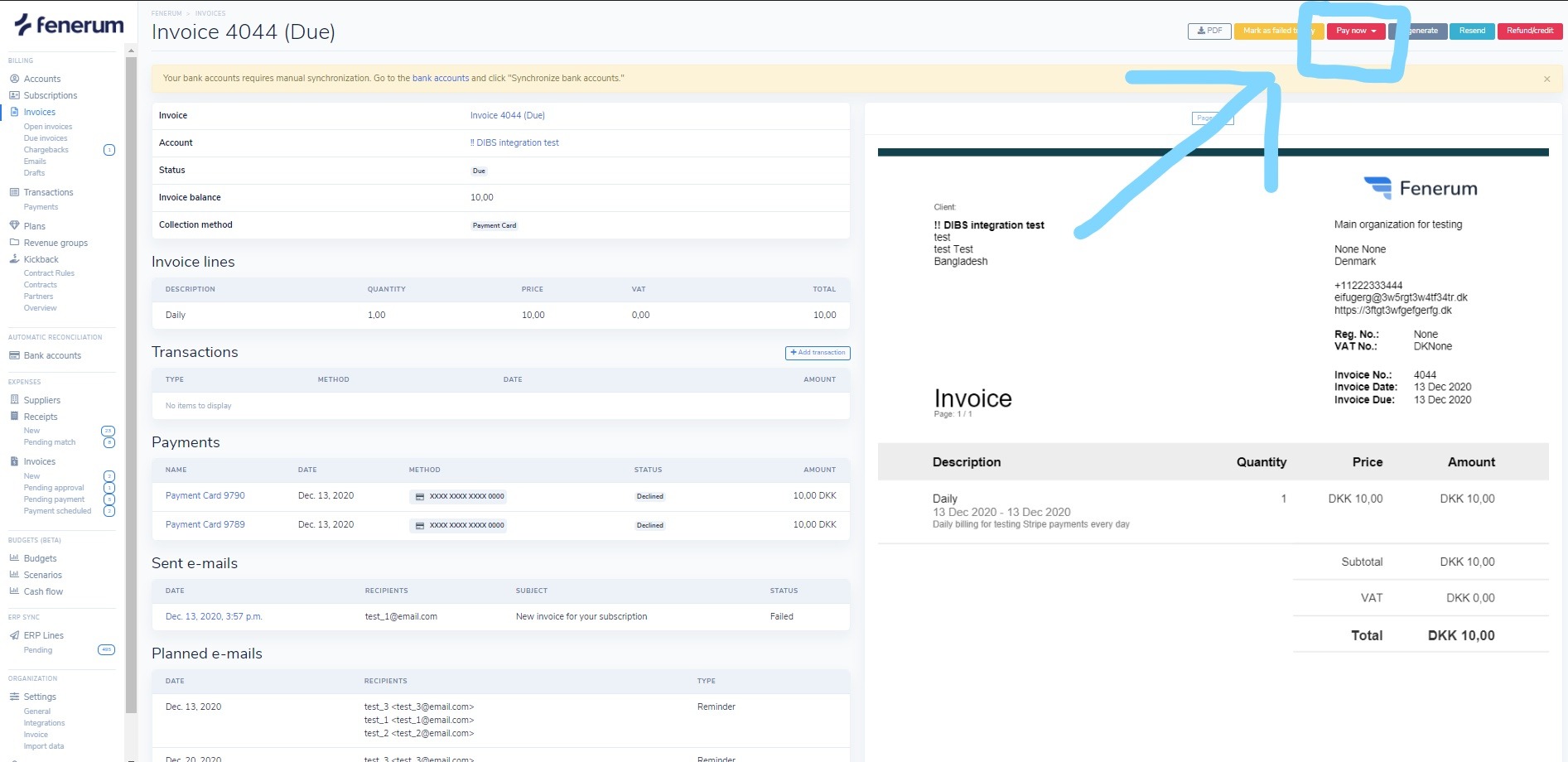

If the customer's credit card has been declined, and an agreement has been reached to reattempt the card. If the customer has an outstanding invoice (applies only if the invoice's payment method is "invoice") that the customer wants to pay only on their credit card. In both situations, you need to press the Pay-now button. The invoice must have the status "open" or "due" before the button appears.

I can't find the Pay-now button, what do I do?

The Pay-now button is only visible to customers, who have an active credit card or vendor service agreement. So, check if your customer has one of these active on their account.

The button itself is located in the top right corner when viewing an invoice.