What is Dunning?

Dunning is the systematic process of communicating with customers to collect overdue payments on outstanding invoices. The term originates from the word "dun," which means to demand payment of a debt. The Dunning process is a critical component of accounts receivable management, helping businesses maintain healthy cash flow by ensuring timely payment collection.

The Dunning process typically involves a series of escalating communications, from friendly reminders to formal payment demands. Effective Dunning helps businesses reduce outstanding accounts receivable, minimize bad debt, and maintain positive customer relationships while ensuring payment collection.

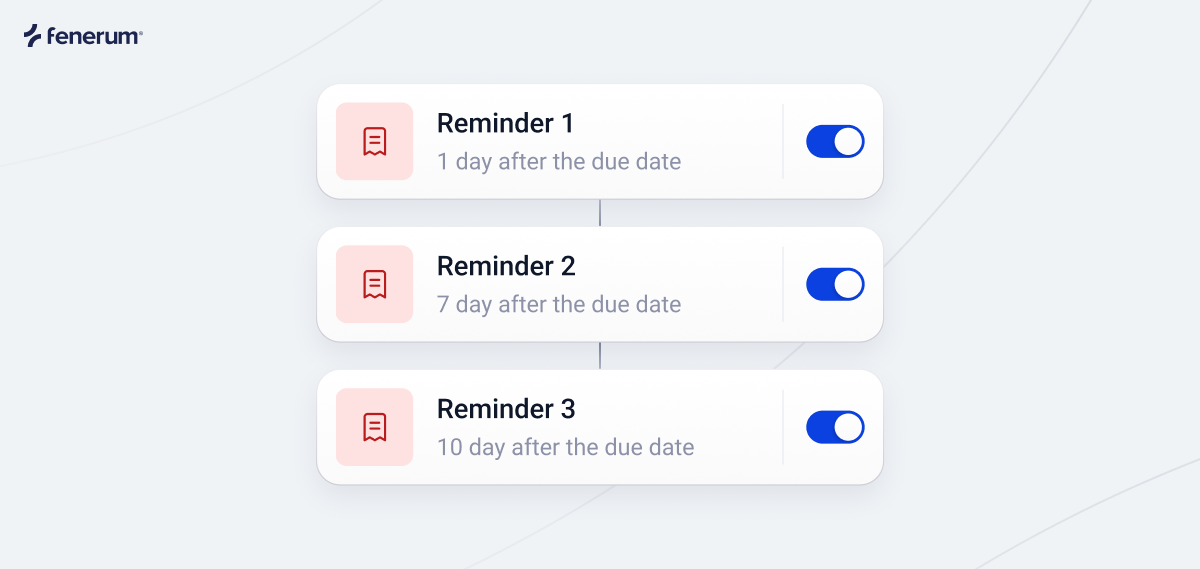

Dunning process example. A visual representation of the Dunning process.

Dunning process example. A visual representation of the Dunning process.

Why you need an effective Dunning process

The biggest killer of SaaS companies is bad cash flow. If you don't have enough cash to pay your bills, you'll go out of business. Implementing an effective and automatic dunning process is the easiest way to improve your cash flow.

Many customers behind late payments don't even know there's a problem. Common reasons for payment failures include outdated credit card information, lost or stolen cards, or insufficient funds. A well-executed Dunning process treats these situations as opportunities to help customers rather than simply demanding payment, which can significantly improve recovery rates and customer retention.

The problem is that traditional Dunning Management is a manual process that is time-consuming and error-prone. It requires a lot of manual work to send out emails or call customers, and it's easy to miss customers or send out the wrong information. This is why it is essential to automate your Dunning process.

4 best practices for Dunning

1. Use payment card or direct debit for recurring payments

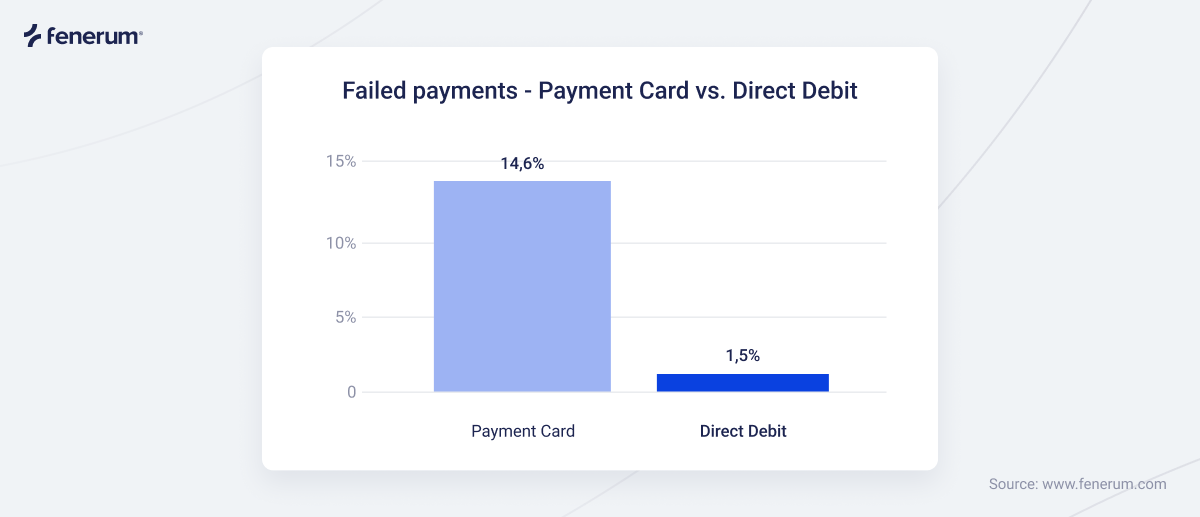

Using payment cards for recurring payments is of course a no-brainer. However, as mentioned above, payment cards often fail due to outdated credit card information, lost or stolen cards, or insufficient funds. Direct debit is a great alternative as it is not as susceptible to these issues. Our own data shows that 14.6% of payment cards fail to collect payment on time, whereas direct debit only fails 1.5% of the time.

With Fenerum you can easily offer payment card and direct debit in Denmark through Leverandørservice and SEPA Direct for most of Europe.

Failed payments comparring Payment card vs. direct debit. (Direct Debit soures include SEPA Direct Debit and Leverandørservice)

Failed payments comparring Payment card vs. direct debit. (Direct Debit soures include SEPA Direct Debit and Leverandørservice)

2. Implement Dunning software

Dunning software is a digital solution that helps you automate your Dunning process. When choosing dunning software, you should look for a solution that offers the following features: sending automatic reminders at predetermined intervals, automated email sequences, customizable email templates, and payment tracking.

Fenerum is a great Dunning solution for SaaS companies as it offers all of the features mentioned above as well as subscription management, billing and reporting.

3. Use custom email frequency

Depending on whether your customer pays an old-school invoice, through credit card, or direct debit, you should send out emails at different frequencies. Why? Because the customer is more likely to pay if they are reminded at a frequency that is appropriate and legally correct for their payment method. For example, in Fenerum you can easily configure the frequency of emails for each payment method.

4. Use custom email templates

Similar to the point above, depending on whether your customer pays an old-school invoice, through credit card, or direct debit, you should use different email templates. Custom email templates are a great way to ensure that your Dunning emails are consistent, professional, and fit your brand. With Fenerum you can easily create and customize your own email templates.

Why is Dunning in SaaS important?

For SaaS businesses, Dunning plays a unique role since most revenue comes from recurring subscriptions and automated billing. A great Dunning process can save potential customers when done correctly—treating payment failures as opportunities to help customers rather than simply demanding payment. Dunning SaaS solutions help reduce manual work, improve collection rates, and maintain better cash flow management, which is critical for SaaS companies managing large volumes of recurring transactions.

The benefits of effective Dunning in SaaS extend beyond revenue recovery. A well-executed Dunning process can reduce overall churn, improve customer experience, and strengthen customer relationships by demonstrating that your company cares about helping customers stay with your service.

Conclusion

Dunning is an essential process for maintaining healthy accounts receivable and cash flow. Whether managed manually or through Dunning software and Dunning SaaS solutions, an effective Dunning process helps businesses collect overdue payments professionally and efficiently. By implementing systematic Dunning procedures, companies can improve their financial health while maintaining positive customer relationships.