What is Revenue Recognition?

Revenue Recognition, or in Danish "periodisering," is a process where a company distributes revenue and expenses over the periods they actually pertain to. For example, with an annual subscription or service, the amount is allocated across all 12 months instead of being recorded entirely in the month the payment is received. This provides a more accurate view of the company’s finances, particularly for long-term projects or large expenses that span multiple accounting periods.

Is Revenue Recognition Mandatory?

In Denmark, companies are legally required to recognize revenue and expenses over time if they are subject to annual financial reporting obligations. While there are some exceptions, this rule generally applies to most companies in Denmark, regardless of size or industry.

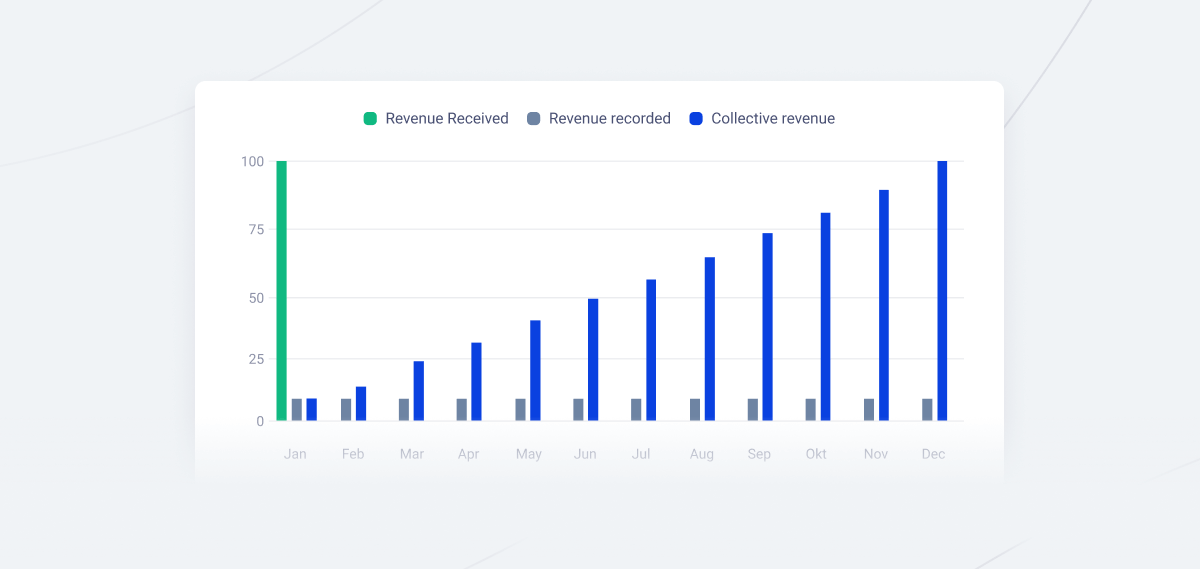

Example of linear revenue recognition (evenly distributed revenue per month).

Example of linear revenue recognition (evenly distributed revenue per month).

Example of Revenue Recognition for a SaaS Company

Revenue Recognition plays a central role in SaaS companies (Software-as-a-Service) since these companies often operate with subscription-based revenue models, where customers pay for software access over a specified period. In the SaaS world, it is crucial to distribute revenue over the periods when the service is actually delivered to ensure accurate and fair accounting and reporting.

Example

If a customer pays 10,000 DKK for an annual subscription to a SaaS solution at the beginning of the year, this revenue must be recognized monthly, with only one-twelfth of the amount recorded each month.

10,000 DKK / 12 months = 833.33 DKK per month

The example above is simplified, and in practice, there are additional factors to consider, such as start date, end date, potential discounts, and other factors that may impact the recognition of deferred revenue. We recommend using a subscription management system that can handle these complexities, automatically recognizing deferred revenue and posting it correctly in your accounting system.

With Fenerum, you can recognize revenue in five different ways, and the deferred revenue is automatically posted in e-conomic, Dinero, Business Central, or any of the other accounting systems we integrate with.

This provides a realistic view of the company’s ongoing revenue and offers a better understanding of how stable and predictable the revenue stream is. SaaS companies also benefit from Revenue Recognition by being able to present more consistent and stable monthly revenue reports, such as MRR (Monthly Recurring Revenue).

Why is Revenue Recognition Important in Accounting?

It is crucial for companies to recognize revenue and expenses accurately, as it helps present more reliable accounting and reporting. A revenue-recognized accounting practice ensures:

- Accurate Financial Reports: Revenue Recognition allows for the presentation of the most precise financial data on the company’s performance in a specific period.

- Improved Financial Planning: By distributing expenses and revenue over the relevant periods, management can better predict cash flow and plan for future investments.

- Regulatory Compliance: Revenue Recognition is essential for complying with accounting standards and ensuring that the company meets legal requirements in accounting practices.

Conclusion

Revenue Recognition is an indispensable tool for any company seeking a precise and fair view of its finances. By recognizing revenue and expenses over the relevant periods, companies ensure that their financial statements reflect actual economic activity, making it easier to make informed decisions. With tools like Fenerum, which can automatically recognize revenue and post it correctly in your accounting system, the process becomes both simpler and more reliable.