TripleTex setup to Fenerum

Initial Setup

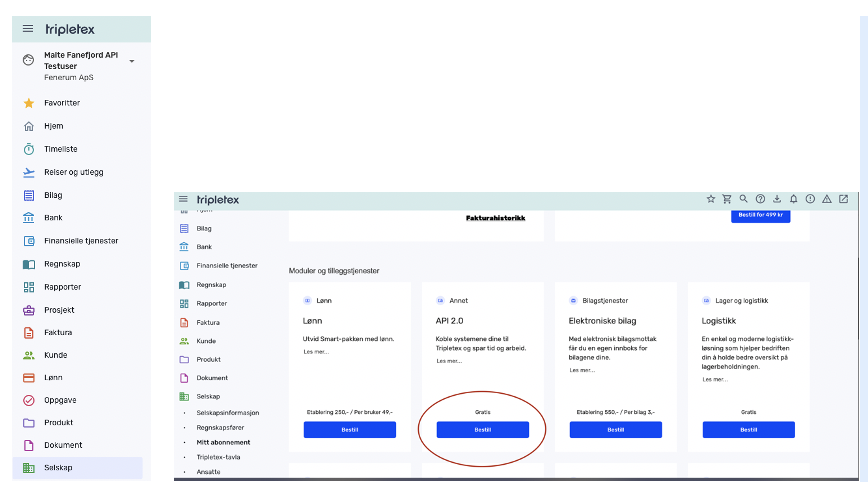

To use Fenerum, you need Smart or Komplett org. in Tripletex, and enable the API 2.0 by going to Selskap > Mitt abonnement > API 2.0 Bestill.

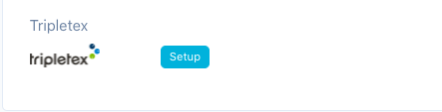

To connect TripleTex to Fenerum, you need to go to the "Integrations" tab under "Settings" and find "TripleTex integration" There, you will find the button "Connect."

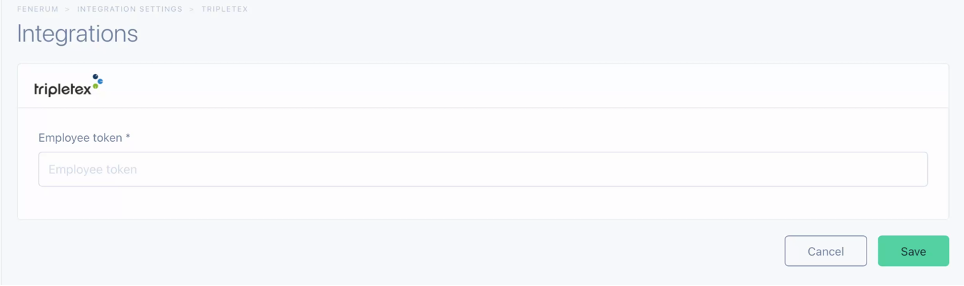

Clicking this button will allow you to fill out an API key.

You must log in to your TripleTex org. And copy paste the API key.

Please be very careful when you copy-paste the API key, don't double-click on the key and copy, the last symbol “ =” will not be included. Instead drag your mouse and select the whole code and then copy it.

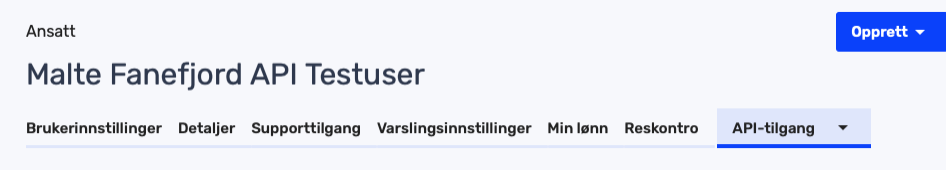

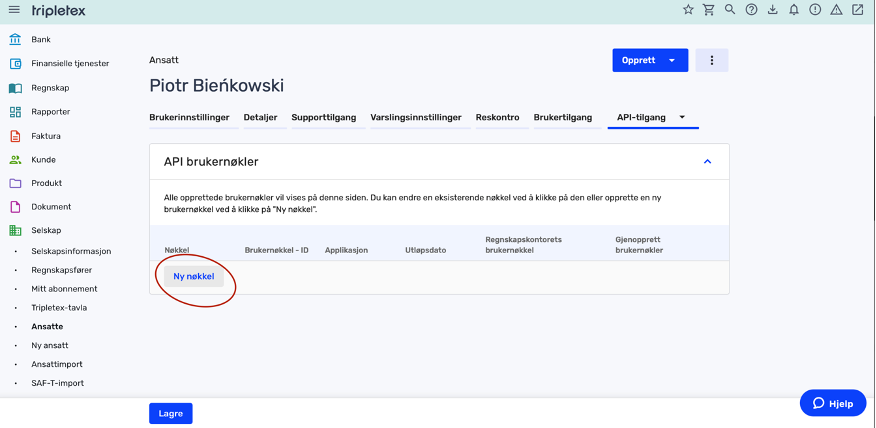

You will find the API key by going to your profile.

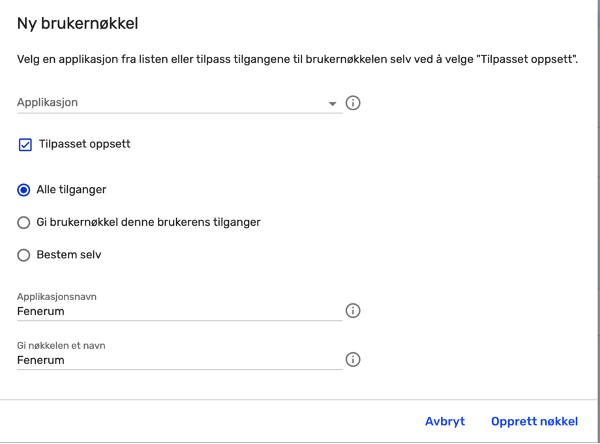

IF you don't have an API key, then you must create one:

IF you don't have an API key, then you must create one:

After importing data, you will need to set up your ERP accounts settings for correct bookkeeping.

Account Mapping

Be cautious while configuring that as wrong values will cause bad booking lines in your ERP system!

You need to set up your chart of accounts and custom TripleTex settings on this screen.

The way Fenerum books revenue is described in this guide.

For information about "Debtor settlement account," please refer to this guide.

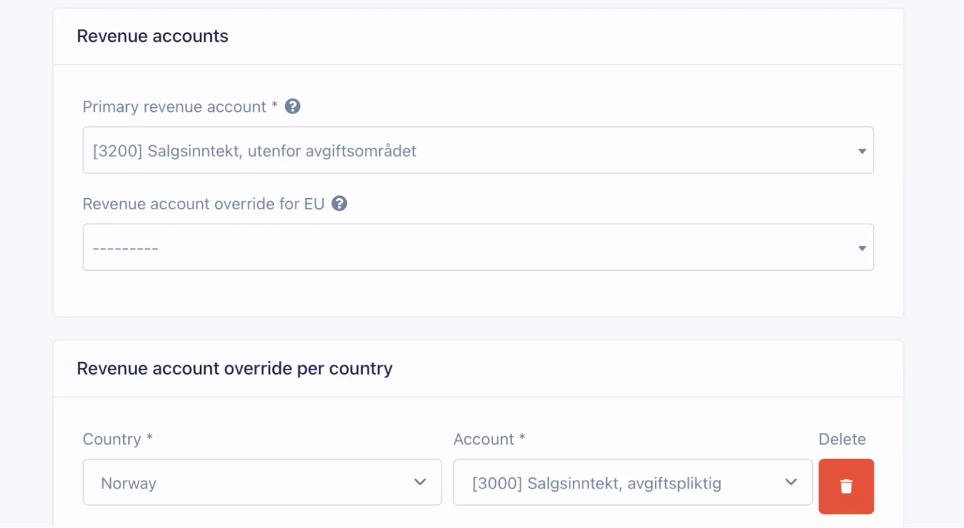

Primary revenue account – revenue account for three countries

Primary revenue account – revenue account for three countries

No need to feel out the EU revenue account. You only need this if you are in the EU.

Add new revenue account – select Norway and your revenue account.

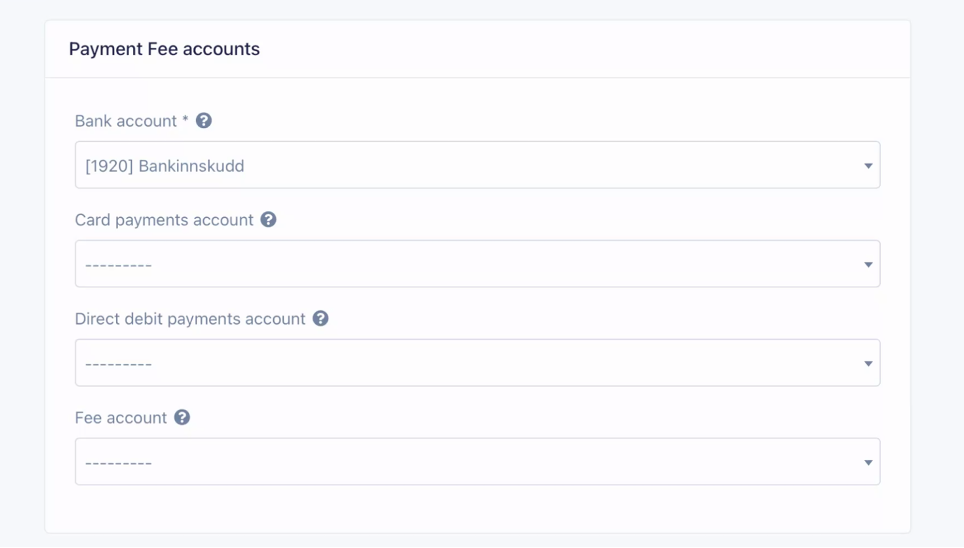

Bank account – Your bank account is from TripleTex.

Bank account – Your bank account is from TripleTex.

Card payments account – If you have an account for all your card payments, you must fill this field and the free account.

Fee account – invoice fee/card fee.

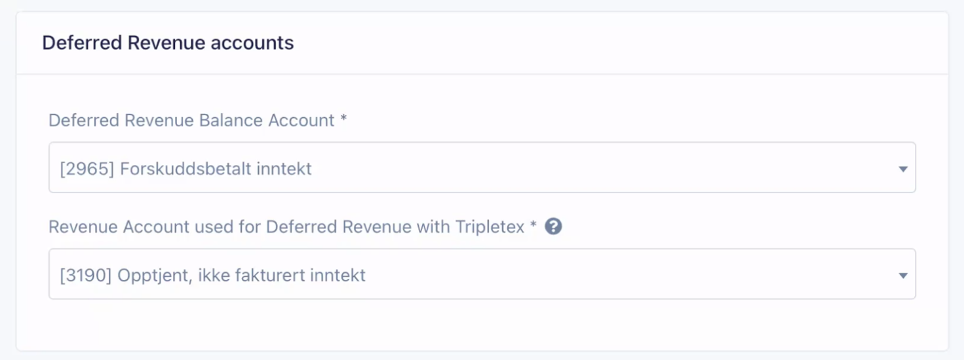

Deferred revenue balance Account – Fenerum needs an account to place all the Deferred revenue. Add it here if you have an account other than account 2965.

Deferred revenue balance Account – Fenerum needs an account to place all the Deferred revenue. Add it here if you have an account other than account 2965.

Revenue Account used for Deferred revenue with TripleTex – You can’t book the revenue back on the revenue account in TripleTex because of the rules they have (can't make more than one booking on a revenue account with a VAT code). You must place the accrual somewhere else, e.g., Account 3190, if you have another account for accrual, you add that account here.

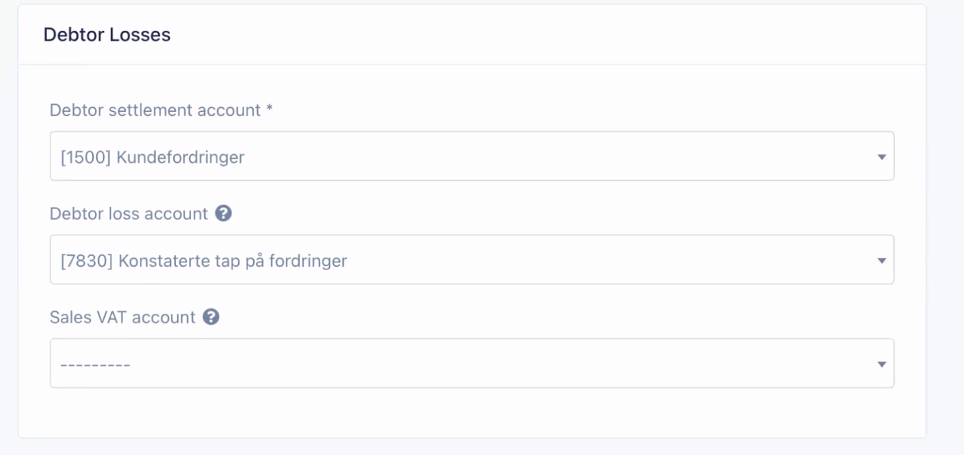

Debtor settlement account – We need an account to place all the transactions from Fenerum in your ERP system. TripleTex will place these transactions out on the respective accounts.

Debtor loss account – account for loss debtor.

Sales VAT account – the VAT account for sales VAT.

When everything is filled out, click "Save". Fenerum will now ask you to review your settings once again.

If you confirm that the settings are correct and save them, your TripleTex synchronization is ready to use.

If you need to change this data or import new customers, you can always go to

Integrations -> Settings and start the same wizard again.

FAQ

Why can't I see due date/amount without VAT on invoices in Tripletex?

As Fenerum generates the invoices, rather than Tripletex. It is not possible with the current Tripletex API to transfer these fields from Fenerum to Tripletex. This doesn't mean that your accounting is wrong, but just that you cannot use the reporting around invoices in Tripletex.